Trust & Estate Services

Thoughtful support for long-term family and legacy planning.

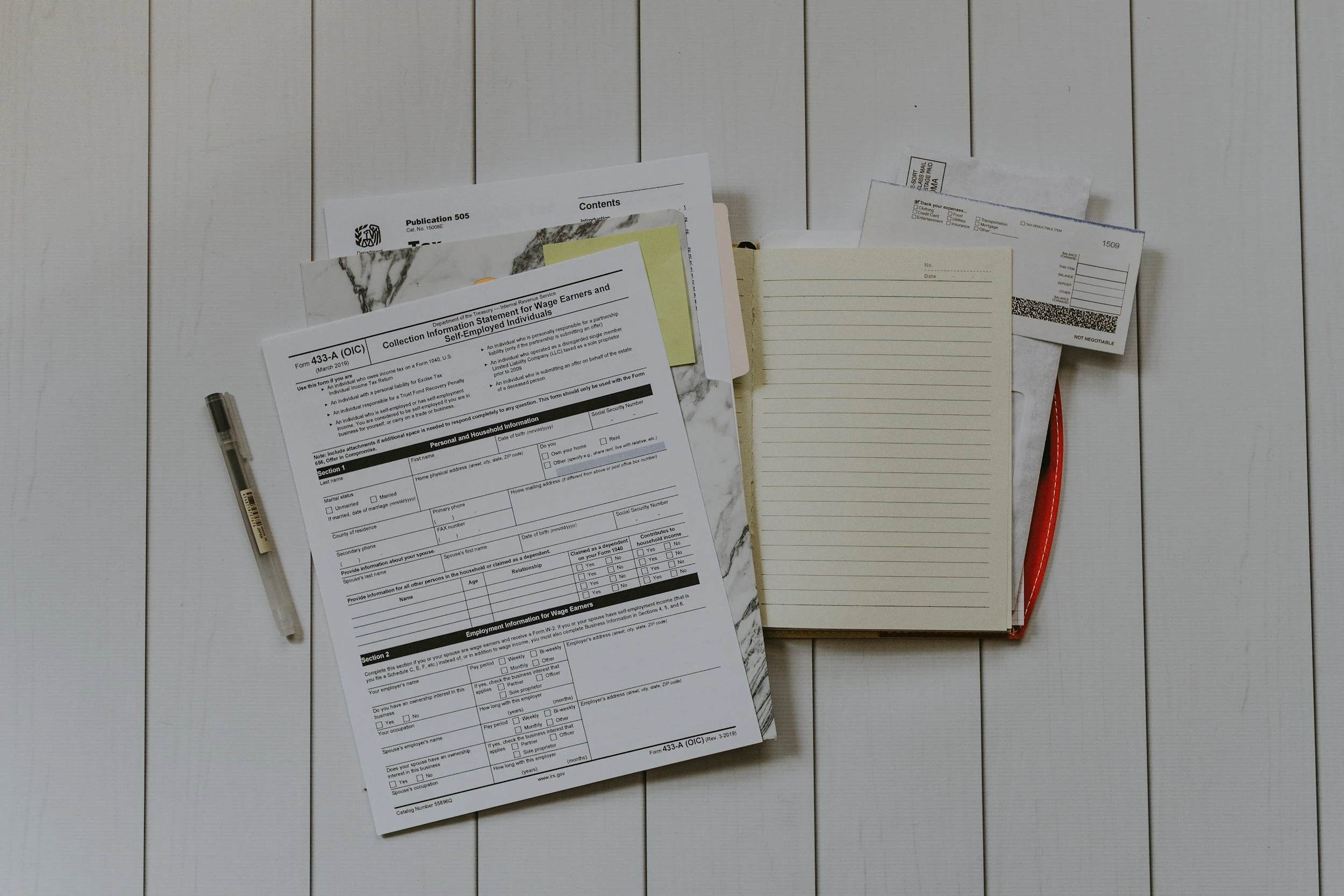

What We Offer

-

Our trust and estate tax preparation services ensure accurate, timely, and compliant filings during sensitive and often complex circumstances. We prepare fiduciary income tax returns with careful attention to reporting requirements, beneficiary distributions, and evolving tax obligations, while providing clear guidance to trustees and executors throughout the process.

-

Estate planning on your own can be complicated and costly. The critical pieces to this puzzel can feel endless. The most pressing of these being state taxes, probate courts, unfair appraisals, health care concerns, eligibility of heirs, life insurance, IRA's, 401K's, annuities, burial or cremation costs, and intent regarding death-postponing treatment. Not knowing your legal and financial rights often ends up costing you more in the end.

Thoughts of estate planning often bring more questions than answers: Could an heir be too young to inherit? Should the inheritance be given at a certain age? Is the intended beneficiary in a shaky marriage with divorce as a possibility? Are there children from a previous marriage? Should inheritance be protected from potential creditors of the heir? Are there taxes that can be avoided? Are you able to avoid the probate court rules, delays, and costs?

Planning what happens to your estate when you're gone can seem frustrating and intimidating without qualified help.

You may feel that you're too young to care about estate planning. Or, perhaps the reminder of death makes you uncomfortable. You might be tempted to put the whole thing off, assuming that it will just take care of itself. In all cases, estate planning ends up saving your family lots of time, heartache and money.

And we can help.

Every estate planning situation is different. In order to help you, we want to know you, your unique situation, and the nature of your relationships. We offer discussion, recommendations and useful research tools to make your planning simple, efficient, and worry-free. We are available throughout the process for further discussion regarding questions, change of circumstances, and alternatives. At every step, we will be there with you.

We can help you:Clearly define your estate planning goals.

Organize and create your estate planning team (experts on law, finance, and taxes) if you need one.

Evaluate and recommend estate planning options.

Prepare, organize and review your estate planning documents including current wills, trusts, health care and power of attorney.

Decrease the problems and expenses associated with probate.

Lessen taxes at time of death.

Arrange for management of your estate in the event you are incapacitated.

Draft a working plan for conserving and effectively managing your estate after death.

Transfer the assets of your estate to heirs the way you want.

Organize fair and adequate liquidation of estate to cover taxes and other expenses.

Amend your plan as needed.

-

We assist clients in the preparation and coordination of living wills and trusts to support effective estate planning and long-term asset management. Our approach emphasizes clarity, proper documentation, and alignment with your broader financial and tax objectives.

-

Our lifetime family wealth transfer services help families move assets across generations in a thoughtful, tax-aware manner. We focus on preserving value, minimizing unintended tax consequences, and supporting continuity through coordinated planning.

-

As your cherished family member gets older, they may need some help with their day-to-day financial tasks. Ordinarily simple tasks such as balancing a checkbook and paying household bills become increasingly difficult for the elderly.

You could take care of their day-to-day financial tasks yourself, if you have the time and live close. But if you don't, you may want to consider hiring a professional to help.

With our elder care services, you get the help of a caring, honest and knowledgeable professional. Someone on your team, looking out for your loved one's best interest.

Your loved ones get assistance with their daily finances and business duties and you are kept informed of every step we make. That way, you always know that your family member's needs are being met.

Whether your loved one is no longer entirely independent or simply needs extra help to enjoy their lives, you get help in any of the following areas...

Reviewing and paying household bills, budgeting, and record keeping.

Assistance with check writing and checkbook balancing.

Making sure money is received, receipted, and deposited.

Offering second opinions regarding household issues and unexpected situations.

Handling day-to-day financial transactions such as home repairs, routine maintenance, and emergency medical expenses.

Planning retirement account distributions and safeguard against improper disbursements.

Organizing and reviewing personal, financial, and legal documents to determine what needs to be addressed.

Preparing an inventory of personal assets and investments.

Identifying and planning their retirement income, needs, and goals.

Determining current and long-term cash flow needs by analyzing income and expenses.

Addressing questions about lifestyle, Social Security, pensions, Medicare, and long-term insurance.

Monitoring investment portfolio and other assets in conjunction with their investment advisor.

Preparing, planning and filing income, trust, gift and estate tax.

Providing referrals to local services and agencies.

Arranging proper level of care, transportation, and caregiver assessment.

Our Tax Return Process

-

1. Pre-Engagement

Tax Engagement Agreement reviewed and signed.

-

2. Source Document Collection

Gather W-2s, K-1s, and all other tax documents, then upload to the portal or drop them off at our office.

-

3. Organize & Prepare

Your documents are organized and digitized. The your tax return is prepared by your dedicated professional.

-

4. Review & Assembly

Your return undergoes supervisor and/or partner-level review, then is assembled and delivered for your approval and signature.

-

5. E-Filing & Confirmation

Once approved, your return is securely filed, and our billing team will reach out to finalize your account.

-

6. Finish

Tax returns include next year estimates and comprehensive instructions to remit any payments.