Individual & Family Services

Trusted guidance for every stage.

What We Offer

-

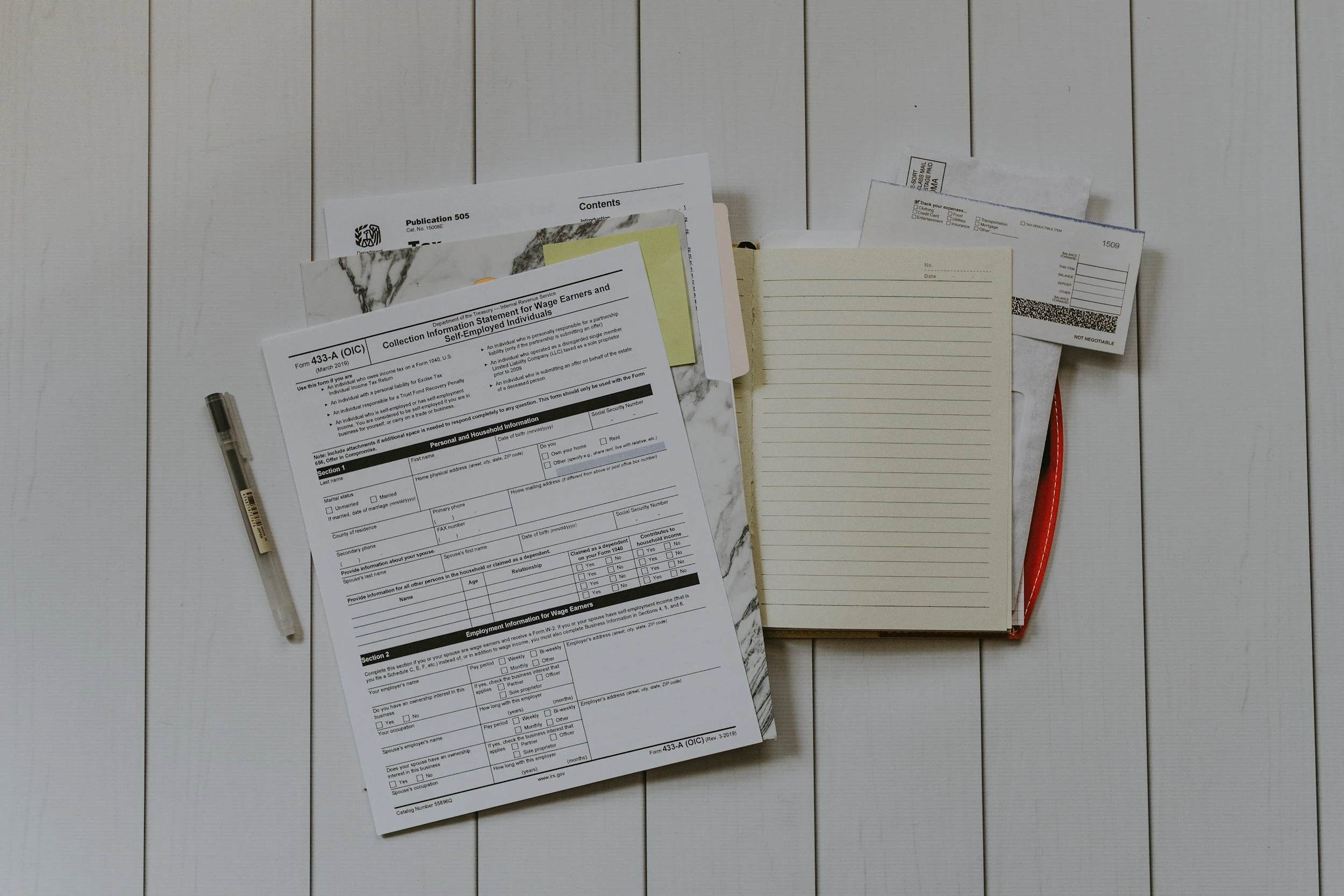

Preparing your own income tax return can often leave you with more questions than answers. According to a study released by the US Government's General Accounting Office last year, most taxpayers (77% of 71 million taxpayers) believe they benefited from using a professional tax preparer.

Today's tax laws can make filing a simple tax return complicated and confusing. It is easy to overlook deductions and credits to which you are entitled; Even if using a computer software program, there's no substitute for the assistance of an experienced tax professional.

Here are the benefits with Small & Camara tax preparation:

Your tax return will be checked and rechecked by our professional software, identifying potential problems the IRS may detect and reviewing the math to limit IRS contacts.

You have the option to file electronically, thus getting your refund back quicker.

Our staff will show you how to adjust your payroll withholding to get more money back each week. Why give the IRS an interest free loan for up to 16 months?

We will show you potential deductions to limit your tax liability for next tax year. In addition, we will give you a sheet of commonly overlooked deductions to also limit the following year's tax liability.

Bookkeeping is a Mess? No Problem!

If you own a small business and haven't kept up your bookkeeping, don't worry. We can help you. We will prepare your bookkeeping for the year with a full Schedule C, as well as your personal income tax return. Then we will help you set up an easy system that allows you to keep your books in tip-top shape next year -

Planning is the key to successfully and legally reducing your tax liability. We go beyond tax compliance and proactively recommend tax saving strategies to maximize your after-tax income.

We make it a priority to enhance our mastery of the current tax law, complex tax code, and new tax regulations by attending frequent tax seminars.

Businesses and individuals pay the lowest amount of taxes allowable by law because we continually look for ways to minimize your taxes throughout the year, not just at the end of the year.

We will recommend Tax Saving Strategies that can help you:

grow and preserve assets by keeping Uncle Sam out of your pockets.

defer income so you can keep your money now and pay less taxes later.

reduce taxes on your income so you keep more of what you make.

reduce taxes on your estate so your family keeps more of what you've made.

reduce taxes on your gifts so you can give more.

reduce taxes on your investments so you can grow your wealth faster.

reduce taxes on your retirement distributions so you can retire in style.

Here's just a few of the Tax Saving Strategies we use:Splitting income among several family members or legal entities in order to get more of the income taxed in lower bracket.

Shifting income or expenses from one year to another in order to have them fall where it will be taxed at a lower rate.

Deferring tax liabilities through certain investment choices such as pension plans, contributions and other similar plans.

Using strategic investments to produce income that is tax exempt from either federal or state, or both taxing entities.

Finding tax deductions by structuring your money to pay for things you enjoy, such as a vacation home.

Remember, we work for you not for the IRS. Many of our clients save in reduced tax liability through careful planning and legitimate tax strategies.

-

Nothing strikes fear in the hearts of people more than receiving an IRS Audit letter in the mail. Audits take significant time away from your business and family, requiring you to gather mounds of records substantiating each and every item reported on your tax return and develop a comprehensive understanding of tax law.

The IRS leaves no stone unturned in its mission to determine the accuracy of your tax return. If you don't comply with the Auditors' wishes, the IRS will recalculate your tax and send you home with a hefty tax bill as your parting gift.

Many taxpayers decide to handle a tax audit themselves, but IRS Auditors are trained to extract more information from you than you have a legal obligation to provide. IRS Auditors know most people fear them and are ignorant of their rights. As a result, Auditors know they can use that fear and ignorance to their advantage.

Rarely do our clients even have to talk with the IRS. We handle it all for you so you don't need to take time from your profession to deal with the bureaucracy and paperwork of the IRS. That means no lost wages or business. You can simply forward the notification of an audit to us and we handle it from beginning to end.

-

If you don't qualify for the IRS Offer In Compromise Program, a Payment Plan may be the best way to resolve your problem. Setting up a payment plan with the IRS gives you a little more time to pay off your tax debts.

Unfortunately, penalties and interest will continue to be charged on your outstanding balance as you pay the debt off. You are required by law to pay the interest on your tax debt.

-

Every day the massive computer center at the IRS is getting more sophisticated, it's only a matter of time before they catch up with you.

This is not a situation to take lightly, failing to file your tax returns is a criminal offense. If you do not file, you can be prosecuted and punished with potential jail time, one year for each year not filed. Why risk potentially losing your freedom for failing to file your tax returns?

Let us give you the peace of mind you deserve by helping you get in compliance with the law. If you voluntarily file your delinquent returns you'll likely avoid further problems other than having to pay the interest and penalties.

If you wait for the IRS to file your returns for you, the returns are filed in the best interest of the government, usually with little or none of the deductions you are entitled to.

Before anything can be done to remove you from this predicament, all delinquent returns must be filed. In most cases, you will likely owe taxes, interest, and penalties after the returns are filed; however, once we see how much is owed, we can then begin a plan of action towards a positive outcome!

-

You have filed your returns but didn't have the money to pay what was owed. You may think, "Oh well---I will catch up next year." Before you know it you find yourself several years in arrears and suddenly there is a notice from the IRS, stating that you owe three or four times the original amount.

It's truly amazing how fast tax penalties and interest add up. Now you have a choice, you can write a big fat check and pay the full amount, including interest and penalties. Or you can just keep ignoring them while the penalties and interest keep piling up.

-

Levies can really do a lot of damage and even ruin your life. A levy is the IRS's way of getting your immediate attention. What they are saying is, we have tried to communicate with you but you have ignored us. Levies are used to seize your wages and whatever other assets you have. If you own it, they can take it. That includes checking accounts, autos, stocks, bonds, boats, paychecks, and even Social Security checks!

Imagine waking up one morning and finding all your bank accounts have been cleaned out. They will take every dime. If this amount did not cover what is owed, they'll keep taking your money until you cover your tax liability. They know that levying your bank account will cause checks to bounce, alerting many people that you have tax problems. But they don't care! Their sole objective is to collect the taxes owed. Period.

As bad as that is, a worse method is a wage levy (or garnishment). That's when most of your pay check goes to the IRS, they don't leave you enough to pay the bills, and most of your check goes to the IRS each and every week until the debt is paid.

If that doesn't accomplish what they want, they'll pull out all the stops. They'll seize your assets, and sell them at auction. That includes everything you own; home, cars, boats, jewelry, motorcycles, insurance polices, retirement funds, anything of value.

We are often able to get those levies released and help you get out of this terrible situation. Our goal is to get you even with the IRS, with what you can afford, and let you start life anew.

-

Levies can really do a lot of damage and even ruin your life. A levy is the IRS's way of getting your immediate attention. What they are saying is, we have tried to communicate with you but you have ignored us. Levies are used to seize your wages and whatever other assets you have. If you own it, they can take it. That includes checking accounts, autos, stocks, bonds, boats, paychecks, and even Social Security checks!

Imagine waking up one morning and finding all your bank accounts have been cleaned out. They will take every dime. If this amount did not cover what is owed, they'll keep taking your money until you cover your tax liability. They know that levying your bank account will cause checks to bounce, alerting many people that you have tax problems. But they don't care! Their sole objective is to collect the taxes owed. Period.

As bad as that is, a worse method is a wage levy (or garnishment). That's when most of your pay check goes to the IRS, they don't leave you enough to pay the bills, and most of your check goes to the IRS each and every week until the debt is paid.

If that doesn't accomplish what they want, they'll pull out all the stops. They'll seize your assets, and sell them at auction. That includes everything you own; home, cars, boats, jewelry, motorcycles, insurance polices, retirement funds, anything of value.

We are often able to get those levies released and help you get out of this terrible situation. Our goal is to get you even with the IRS, with what you can afford, and let you start life anew.

-

You received an IRS Notice of Intent to Levy 30 days ago and you forgot or ignored it. Now it's Payday. Expecting a check, you open the envelope and find that the IRS has taken most of your money. What's left is not enough to pay the rent, car payment, buy groceries, or pay the rest of the bills. This action will continue on every check due you, until the tax owed is paid in full.

Now you're in big financial trouble. No matter how hard you plead with your employer they cannot give you your money. Once a wage garnishment is filed with your employer, your employer is required by law to collect a large percentage of each of your paychecks.

We are regularly retained to negotiate the release of IRS wage garnishments by arranging a payment plan. The payment plan negotiated by us is always more favorable than any IRS wage garnishment. It allows you to receive your whole paycheck without fears of future wage garnishments.

-

Your back taxes, interest and penalties can be wiped out by filing bankruptcy. If you qualify, bankruptcy can be the best solution to resolve your crushing tax problems.

Unfortunately, not everyone qualifies to wipe out their tax debt in bankruptcy. Certain rules have to be met first. If you file bankruptcy and don't meet the rules, the IRS will still be in hot pursuit after your bankruptcy is over. Proper pre-bankruptcy planning is key to determining if bankruptcy is or can be a viable solution.

-

Did you know that you can get out of the tax debt due to the misdeeds or fraud committed by your spouse? Innocent Spouse Relief was designed to alleviate unjust situations where one spouse was clearly the victim of fraud perpetrated by their spouse or ex-spouse.

-

Navigating the tax implications of Bitcoin and other cryptocurrency transactions can be overwhelming, but you don’t have to do it alone. Our team specializes in cryptocurrency taxation, ensuring compliance with IRS regulations while maximizing your tax benefits. Whether you’re a casual investor, a high-volume trader, or a business accepting crypto payments, we provide tailored solutions to meet your needs.

Cryptocurrency transactions are treated as property for tax purposes, which means every transaction—including buying, selling, mining, staking, and even spending Bitcoin—could have tax implications. With constantly changing rules and complex reporting requirements, mistakes can be costly. That’s where we come in.

Our Services Include:

Tax Reporting for Crypto Trades: Accurately calculate and report gains and losses for every transaction.

Mining and Staking Income: Help with reporting income earned through mining or staking activities.

Cost Basis and Record-Keeping: Assist in tracking and calculating the cost basis of your crypto investments.

Tax Optimization Strategies: Identify opportunities to minimize your tax liability, such as through tax-loss harvesting.

IRS Compliance Support: Ensure accurate filings and represent you in the event of an audit or inquiry.

Business Crypto Payments: Guide businesses on the proper accounting and tax treatment of cryptocurrency payments.

In-Person Fiduciary Cold Wallet Setup: Protect your digital assets by moving them off risky exchanges and into secure cold storage. We provide hands-on, fiduciary-level assistance to ensure your cryptocurrency is stored safely and with proper setup, giving you peace of mind.

Whether you’ve been holding Bitcoin since the early days or just started investing in crypto, we stay ahead of the latest regulations to ensure your tax filings are accurate and optimized. Let us take the complexity out of cryptocurrency taxes, so you can focus on your financial goals. Reach out today to see how we can help you take control of your crypto tax strategy and security!

Our Tax Return Process

-

1. Pre-Engagement

Tax Engagement Agreement reviewed and signed.

-

2. Source Document Collection

Gather W-2s, K-1s, and all other tax documents, then upload to the portal or drop them off at our office.

-

3. Organize & Prepare

Your documents are organized and digitized. The your tax return is prepared by your dedicated professional.

-

4. Review & Assembly

Your return undergoes supervisor and/or partner-level review, then is assembled and delivered for your approval and signature.

-

5. E-Filing & Confirmation

Once approved, your return is securely filed, and our billing team will reach out to finalize your account.

-

6. Finish

Tax returns include next year estimates and comprehensive instructions to remit any payments.