Nonprofit & Charity Services

Specialized support for mission-driven organizations.

What We Offer

-

Nonprofit entity formation (state filings)

IRS 501(c) tax-exempt status applications (Form 1023 / 1023-EZ / 1024)

Bylaws & governance structure guidance (non-legal)

State charitable registration & renewals

Employer identification number (EIN) setup

Sales & use tax exemption applications

-

Form 990 / 990-EZ / 990-N preparation

State nonprofit returns & informational filings

Unrelated Business Income Tax (Form 990-T)

Payroll tax filings (941, 940, DE-9, etc.)

State and local compliance (FTB, AG registry, Secretary of State)

Foreign reporting where applicable (FBAR, 5471, etc.)

-

Monthly/quarterly bookkeeping

Chart of accounts designed for nonprofits

Fund accounting & donor restriction tracking

Reconciliation of bank and investment accounts

Financial statement preparation (internal use)

Accrual vs. cash basis conversions

-

Board-ready financial statements

Budget vs. actual analysis

Cash flow forecasting

Grant-specific financial reports

Form 990 tie-out to books

Management dashboards & KPIs

-

Independent Audits

Reviews & compilations

Single Audit (Uniform Guidance) support

Agreed-upon procedures (AUPs)

Audit prep & liaison with external auditors

-

Payroll processing & filings

Reasonable compensation analysis

Executive compensation disclosures (Schedule J)

Employee vs. contractor classification

Fringe benefit & accountable plan setup

State employment compliance

-

Board financial literacy training

Conflict of interest policy guidance

Governance best-practice reviews

Internal controls assessments

Fraud risk assessments

Board reporting structure design

-

Grant budget preparation

Grant compliance tracking

Cost allocation plans

Indirect cost rate calculations

Grant reporting support

Audit-ready grant documentation

-

Item descriptionFinancial sustainability planning

Program profitability analysis

Scenario modeling & forecasting

Mergers, dissolutions, or restructurings

Mission-aligned growth planning

Endowment & reserve policy modeling

-

Segregation of duties design

Cash handling policies

Donation processing controls

Fraud prevention systems

Whistleblower policy guidance

-

Charitable contribution substantiation rules

Donor acknowledgment compliance

In-kind donation valuation guidance

Quid-pro-quo contribution analysis

Political activity & lobbying compliance

Private benefit & excess benefit analysis (Intermediate sanctions)

-

Accounting software selection (QuickBooks, Sage, etc.)

Fund accounting system setup

Chart of accounts restructuring

Automation & workflow optimization

Internal reporting templates

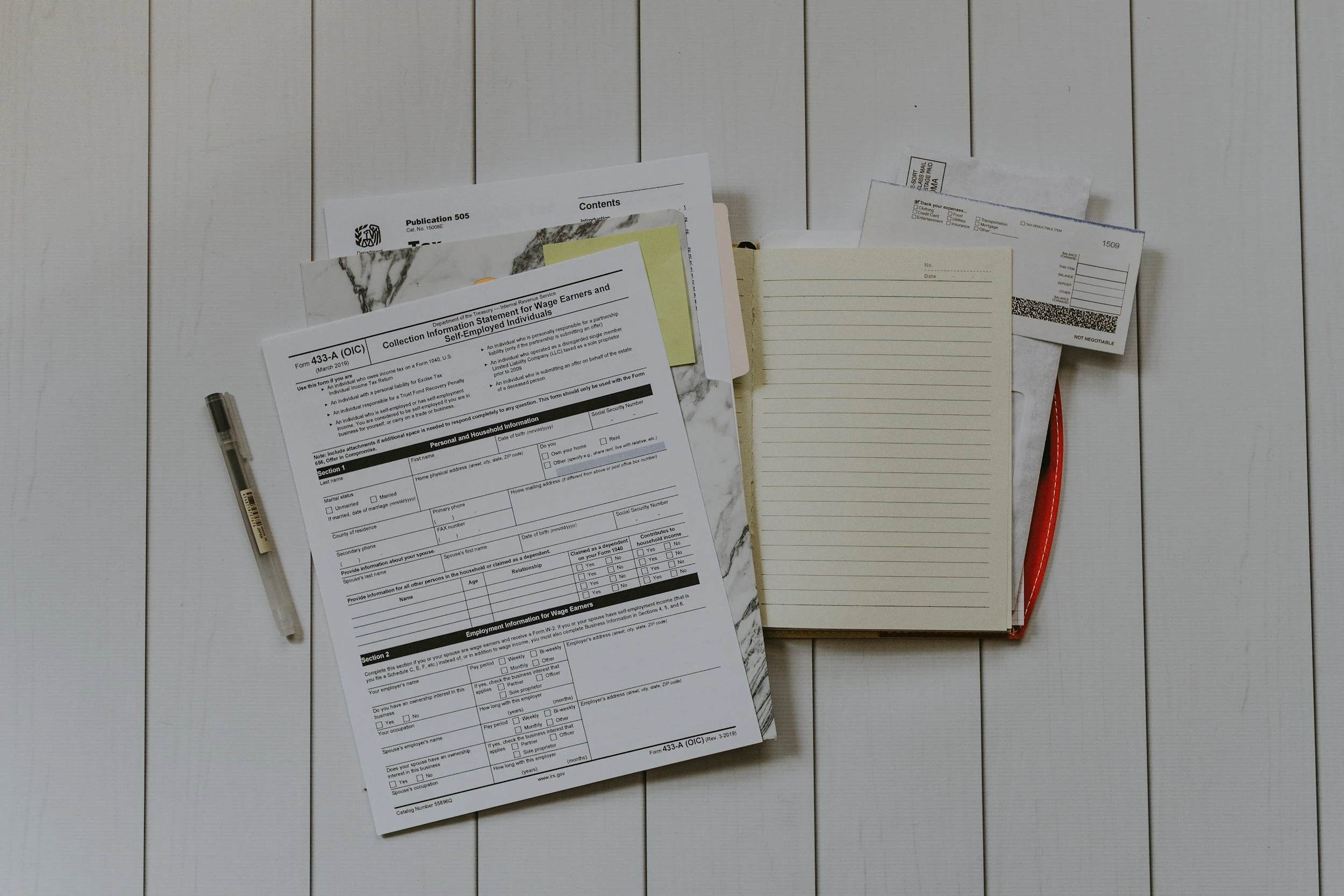

Our Tax Return Process

-

1. Pre-Engagement

Tax Engagement Agreement reviewed and signed.

-

2. Source Document Collection

Gather W-2s, K-1s, and all other tax documents, then upload to the portal or drop them off at our office.

-

3. Organize & Prepare

Your documents are organized and digitized. The your tax return is prepared by your dedicated professional.

-

4. Review & Assembly

Your return undergoes supervisor and/or partner-level review, then is assembled and delivered for your approval and signature.

-

5. E-Filing & Confirmation

Once approved, your return is securely filed, and our billing team will reach out to finalize your account.

-

6. Finish

Tax returns include next year estimates and comprehensive instructions to remit any payments.